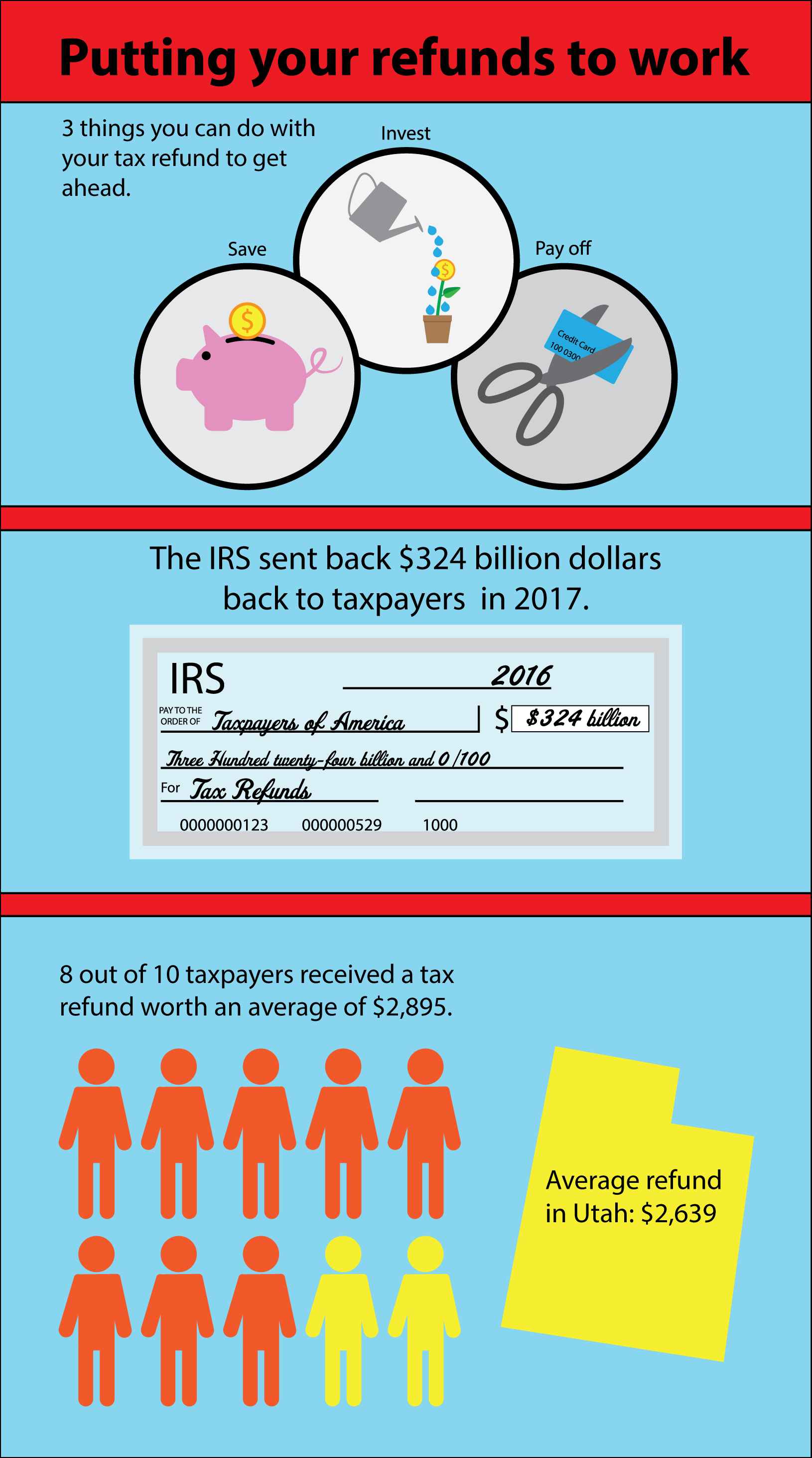

The best of these is the potential for a hefty return. Tax returns raise interesting questions and show us a lot about ourselves: are we the type to use excess cash practically or the type to let loose with it and unwind?

Don’t worry — I’m not here to judge you. Whichever side you’re inclined to, allow me to propose a few ideas:

Practical uses for your refund

According to Forbes.com, the average American saves just over 5 percent of their disposable income. For under 30’s, this rate drops even more.

The Forbes article reported: “This is far too low to adequately prepare most people for retirement and unexpected expenses. …Most experts recommend saving at least 10 percent to 15 percent of your income in order to be financially well-prepared for these things.”

With that in mind, how are your savings doing? What about your retirement account?

According to some of the money experts at CNN, the best time to start putting away for your retirement is in your 20’s. The idea is pretty simple: you’re unlikely to be able to save enough by yourself to retire at any kind of decent age and have enough money to live on.

There are a number of potential tools in your belt to help you retire with confidence, including 401k’s, IRA’s, ROTH IRA’s, mutual funds and index funds. If you want to find out more about these consult with a financial adviser and use your internet resources to get yourself educated.

Local financial adviser, Trent Evans has worked in finance for 10 years.

“It can be a lot to take in for a newcomer,” Evans said. “The best bet is to find an expert you trust and to ask a lot of questions — the more, the better.”

The problem with these tools is that they tend to rely on an interest rate to grow your money over time. Simply put, more time equals more money. This little magic trick is called compound interest and it’s powerful — take the following example from CNN.com:

“Say you start at age 25, and put aside $3,000 a year in a tax-deferred retirement account for 10 years — and then you stop saving — completely. By the time you reach 65, your $30,000 investment will have grown to more than $338,000, (assuming a 7 percent annual return), even though you didn’t contribute a dime beyond age 35.”

CNN goes on to report that starting at 35 and paying the that same $3,000 a year for the next 30 years will net you less cash in the long run. Time is your biggest ally in the retirement race.

Compound interest can also work against you in the form of debt. A great use of your refund is to pay down any debts that might be weighing at you. The quicker it’s gone, the less you’ll pay in the long run.

Alex Horne, a local entrepreneur, said having debt should make you feel uncomfortable.

“When you’re in debt, you wake up poorer than you were when you went to sleep,” Horne said. “Paying off your debts should be your number one priority.”

Fun and games

If all the finance talk has turned off your brain, let me suggest some fun uses for your windfall.

If you’ve got the itch for adventure, maybe you can try seeing the U.S. by train.

Derek Low, a popular travel blogger, details how, for a few hundred dollars and four or five days of your time, you’ll have room and board on a train across the country which cuts through some of the most gorgeous country there is to see.

“The most scenic and historic of all the train routes in America is the cross-country journey from San Francisco to New York,” Low writes. “The 3,400-mile coast-to-coast train ride takes 4 days if you do it without stopovers. Of course, you should make stopovers, but you’ll need to buy separate tickets for each leg.”

If being outdoors is more your thing, I recommend a national park tour of Utah. Utah is the home of five beautiful national parks and no two of them are the same.

Jonathan Michael has worked as a park ranger at Bryce Canyon National Park for two years and he recommends the parks to everyone he meets.

“Utah is just incredible,” Michael said. “And the parks are full of stuff to do that I don’t see enough locals take advantage of. If anyone hasn’t been to the parks yet, it’s a must-do trip.”

According to the National Park Service’s website, an annual pass to every park in the nation will run you $80. Leave yourself a few hundred dollars for gas, food and campgrounds, borrow a tent if you don’t already have one, and take five days to see the parks.

The NPS website has great resources for planning your trip, lists of available activities, and schedules of events.

The great thing about this trip is that it’s completely up to you how involved you want to make it. There are options for skydiving, river rafting, rock climbing, bike tours and a number of other things that might interest the would-be adventurer. Plan your trip well, make some good inquiries about what services are available, and above all else, go at your own pace.

Whether you decide on practicality or letting your hair down, my recommendation is to plan well, make the most of your money, and reap the benefits.